Content

Also, this account is called a controlling account since it promotes the performance of reconciliation control concerning the ending balance. Therefore, this account enables individuals to reconcile the total balance of the subsidiary ledger with the aggregate balance to be applied within the trial balance. A control account is created as a tool for reconciling the journal entries and the general ledger.

- A general ledger contains all balance sheet and income statement accounts.

- Hence, this account ensures the aggregate amount is similar, and if there is no similarity, it indicates the error-promoting correction and investigation of all discrepancies.

- That is why control accounts are used to summary data from large numbers of related accounts.

- A company that sells products on credit may have many transactions in the accounts receivable subledger.

If the discrepancy is significant, then actions such as stock counts can be triggered in order to validate stock and correct the balance sheet and clear the control account. Under control accounts, Sage 100 Contractor uses the accounts you designate to automatically post certain transactions to the correct ledger accounts. For example, when you post a receivable invoice, you do not need to supply the accounts receivable ledger account. After posting a transaction to the general ledger, Sage 100 Contractor locks the account numbers for the accounts under Controlling Accounts.

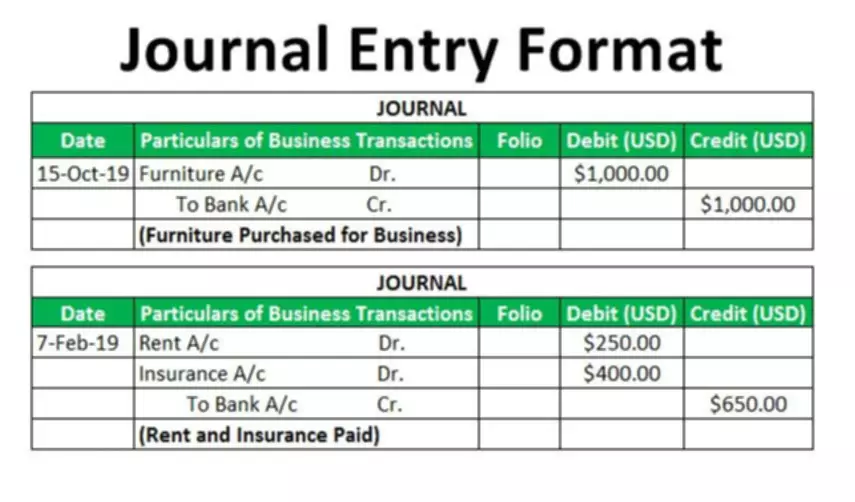

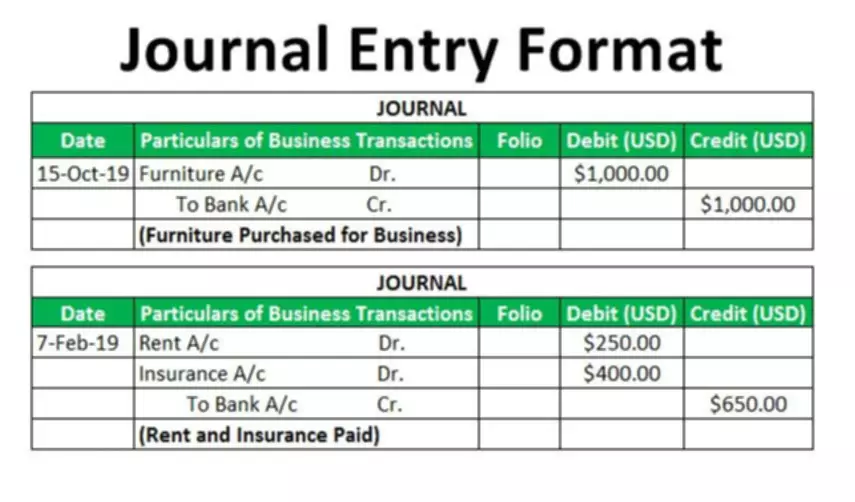

Example of Control Account

The main account needs to be shown in the financials (the parties have maintained, i.e., an individual account for the same nature of transactions, and the summarized balance is shown). Simply put, as you know in large organizations there are numbers of customers as well as suppliers. So, if you record each transaction (account payable and account receivable) in the general ledger, it will become too difficult to manage your records easily. Thus, in order to keep a proper record, you have to maintain control accounts and subsidiary accounts.

- A subsidiary ledger deals with the storage of the information for the general ledger account, so it provides a tool for reconciliation between the general ledger and the journal entries.

- And as payments come in, the control account is credited, decreasing the balance.

- This way the ledger only has one accounts receivable account instead of hundreds.

- If the totals do not agree, then a reconciliation of the control accounts must be made.

- After posting a transaction to the general ledger, Sage 100 Contractor locks the account numbers for the accounts under Controlling Accounts.

In the general ledger, there are hundreds of thousands of accounts including expenses, income, liabilities, and asset accounts. Similarly, if every transaction will be recorded in the general ledger, it would become very difficult to organize the general ledger properly. Therefore, we need to have a separate controlling account for each account such as for accounts payable and accounts receivable. In addition, it provides organized and correct ending balances of specific account types for preparing financial statements. Moreover, it bring forth accuracy of analysis because it provides double-check of ending balances of each account.

The Accounting Gap Between Large and Small Companies

In accounting, the https://www.bookstime.com/articles/enrolled-agent-exam (also known as an adjustment or control account[1]) is an account in the general ledger for which a corresponding subsidiary ledger has been created. The subsidiary ledger allows for tracking transactions within the controlling account in more detail. Individual transactions are posted both to the controlling account and the corresponding subsidiary ledger, and the totals for both are compared when preparing a trial balance to ensure accuracy. You can use the

dimensions to split the transactions on the customer and supplier control

accounts by departments, persons responsible for the revenues, costs,

properties, debts, and so on. All the additional control accounts of the

business partner groups must use the same dimensions as the control account

linked to the default sale type or purchase type. Smaller companies may be able to rely on control accounts if they remain balanced using double-entry accounting.

For example, non-trade sales invoices can concern the sale of

fixed assets, intercompany transfers, and so on. This account is created to record the summarized balance of the individual ledgers maintained for different parties in accounting for the transactions. E.g., it may be a separate account designed for vendors and maintained, which summarizes the personal accounts. Hence, generally, the individual account balancesAccount BalancesAccount Balance is the amount of money in a person’s financial account, such as a savings or checking account, at any given time.