Content

If the request is denied, the back-up section 444 election must be activated (if the partnership, S corporation, or PSC otherwise qualifies). A PSC with a section 444 election in effect must distribute certain amounts to employee-owners by December 31 of each applicable year. If it fails to make these distributions, it may be required to defer certain deductions for amounts paid to owner-employees. The amount deferred is treated as paid or incurred in the following tax year. Form 8752, Required Payment or Refund Under Section 7519, must be filed each year the section 444 election is in effect, even if no payment is due. If the required payment is more than $500 (or the required payment for any prior year was more than $500), the payment must be made when Form 8752 is filed.

C corps are automatically taxed under Subchapter C of the Internal Revenue Code, so there is no need to file additional documentation with the IRS to be taxed as a C corp. LITCs represent individuals whose income is below a certain level and need to resolve tax problems with the IRS, such as audits, appeals, and tax collection disputes. In addition, clinics can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. To find a clinic near you, visit TaxpayerAdvocate.IRS.gov/about-us/Low-Income-Taxpayer-Clinics-LITC or see IRS Pub. Go to IRS.gov/Account to securely access information about your federal tax account.

Tips for Effective Bookkeeping

These records are crucial for establishing each shareholder’s percentage of ownership in the company. Once you have set up your accounting method and filed your first return, generally, you must receive approval from the IRS before you change the method. A change in your accounting method includes a change not only in your overall system of accounting but also in the treatment of any material item. A material item is one that affects the proper time for inclusion of income or allowance of a deduction. Although an accounting method can exist without treating an item consistently, an accounting method is not established for that item, in most cases, unless the item is treated consistently.

- This includes business expenses for which you contest liability.

- If you do, you’ll need to designate your company — the Internal Revenue Service views all incorporated businesses as C corporations by default.

- Although the tax preparer always signs the return, you’re ultimately responsible for providing all the information required for the preparer to accurately prepare your return.

- To take money out of the company for yourself — and to avoid paying tax on shareholder distributions — you’ll need to know your shareholder basis so you don’t exceed the limit.

- No shareholder is personally responsible for the liabilities and debts of the business.

- If the required payment is $500 or less and no payment was required in a prior year, Form 8752 must be filed showing a zero amount.

- The S Corporation works like any other corporation through the relevant by-laws that govern corporations.

See the Instructions for Form 2553PDF for all required information and to determine where to file the form. A corporation is a legal entity created under the laws of a particular state. It is distinct from its owners, who are called shareholders and has its own legal existence. S Corporation shareholders will be able to save $3,060 in payroll income tax.

S Corporation Basic Bookkeeping

If you are subject to this exception, you have the option to treat upfront payments that satisfy the criteria for the specified good exception as a typical advance payment under section 451(c). Under section 451(c), the advance payment is included in gross income under the full inclusion method or the 1-year deferral method. Indirect ownership is generally taken into account if the stock is owned indirectly through one or more partnerships, S corporations, or qualified PSCs. Stock owned by one of these entities is considered owned by the entity’s owners in proportion to their ownership interest in that entity. Other forms of indirect stock ownership, such as stock owned by family members, are generally not considered when determining if the ownership test is met.

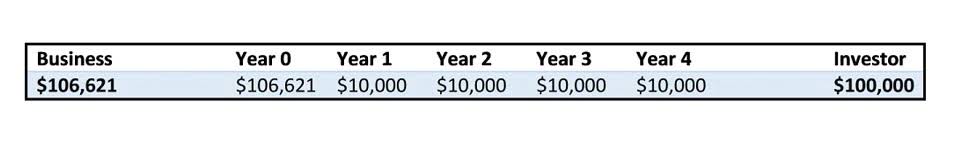

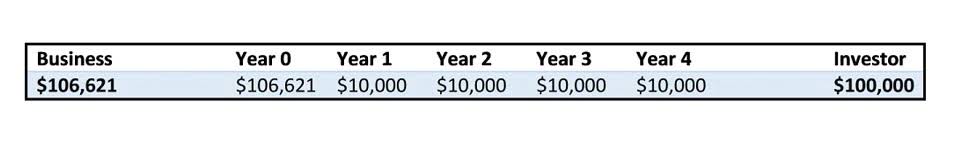

https://www.bookstime.com/articles/what-is-cost-accounting-and-how-does-it-work is an important part of running your corporation and maintaining your special S corp tax election. You will need to keep accurate records of your business transactions so that you can fulfill your annual reporting requirements. In most cases, hiring a professional bookkeeper is the best way to maintain your corporation’s financial records. Additionally, imagine the following scenario where two people own 25% of a company for a total of 50%.

Error-free tax filing

But even if your firm falls below the $250,000 threshold, it’s still a good idea to maintain a balance sheet throughout the year, and include it with your filing. The capital account is adjusted from time to time to reflect additional equity investments, as well as at the end of the year to reflect each shareholder’s pro-rata share of income s corp bookkeeping and expenses. Our Bench team is full of experts that can handle your bookkeeping and tax preparation. In running your business, you’ve got plenty on your plate — let us take worrying about the intricacies of your books and financials off of it. Calculating shareholder basis is one of many intricacies of owning a small business.

However, an election can be made anytime during the prior year for election to take effect the following year. Wajiha is a Brampton-based CPA, CGA, and Controller with 17+ years of experience in the financial services industry. She holds a Bachelor of Science Degree in Applied Accounting from Oxford Brookes University and is a Chartered Certified Accountant.

The Effects of Revenue Recognition on Financial Statements

It can be helpful to have a CPA or professional tax advisor on your side. If you have losses, you can carry them over into the next year. Those losses are treated as being incurred in the following tax year, but can only be deducted after you increase the basis.